Portfolio diversification and model uncertainty: a robust dynamic mean-variance approach

Presenter

June 13, 2018

Keywords:

- Mean-variance problem, model uncertainty, correlation ambiguity, portfolio diversification, McKean-Vlasov differential game.

Abstract

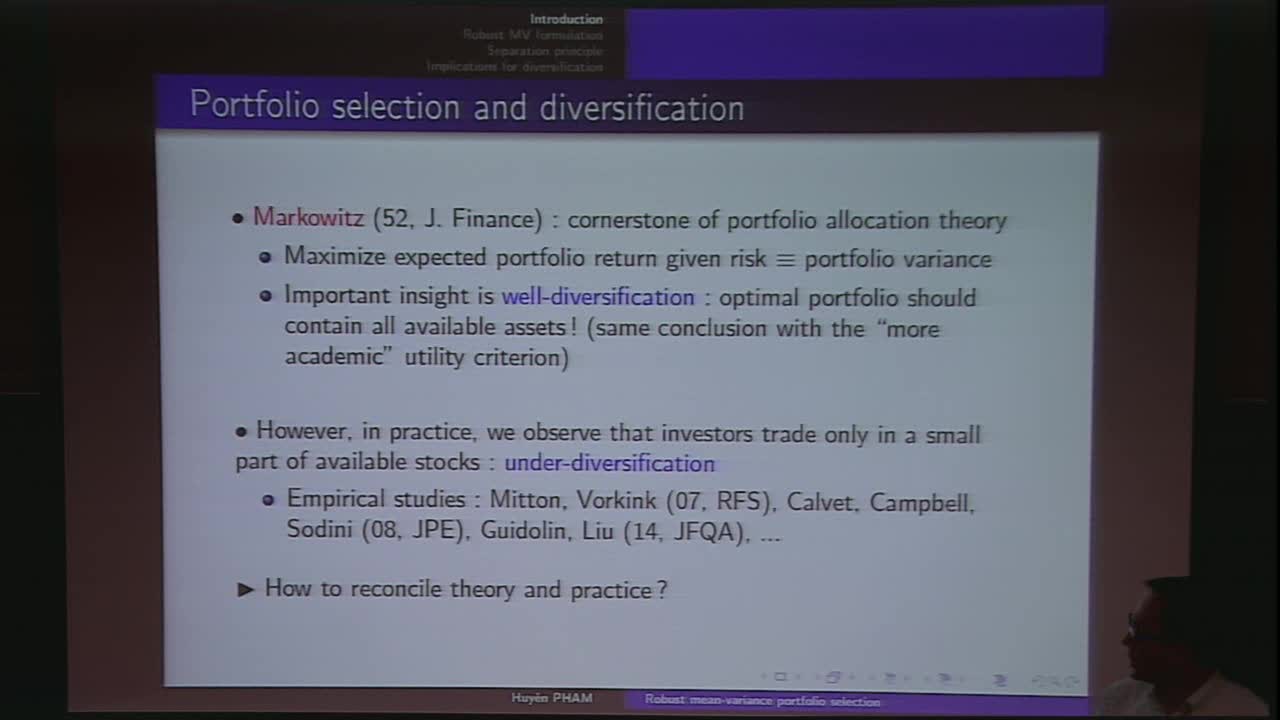

This talk is concerned with multi-asset mean-variance portfolio selection problem under model uncertainty.

We develop a continuous time framework for taking into account ambiguity aversion about both expected rate of return and correlation matrix of stocks, and for studying the effects on portfolio diversification.

We prove a separation principle for the associated robust control problem formulated as a mean-field type differential game, which allows to reduce the determination of the optimal dynamic strategy to the parametric computation of the minimal risk premium function.

Our results provide a justification for under-diversification, as documented in empirical studies, and that we explicitly quantify in terms of correlation and Sharpe ratio ambiguity parameters.

In particular, we show that an investor with a poor confidence in the expected return estimation does not hold any risky asset, and on the other hand, trades only one risky asset when the level of ambiguity on correlation matrix is large. This extends to the continuous-time setting the results obtained by Garlappi, Uppal and Wang [RFS 07], and Liu and Zeng (2017) in a one-period model.

Based on joint work with Xiaoli Wei (Paris Diderot) and Chao Zhou (NUS).