Regularized Estimation in High-dimensional Time Series Models

Presenter

April 27, 2018

Keywords:

- time series, high-dimensional statistics, lasso, vector autoregression

Abstract

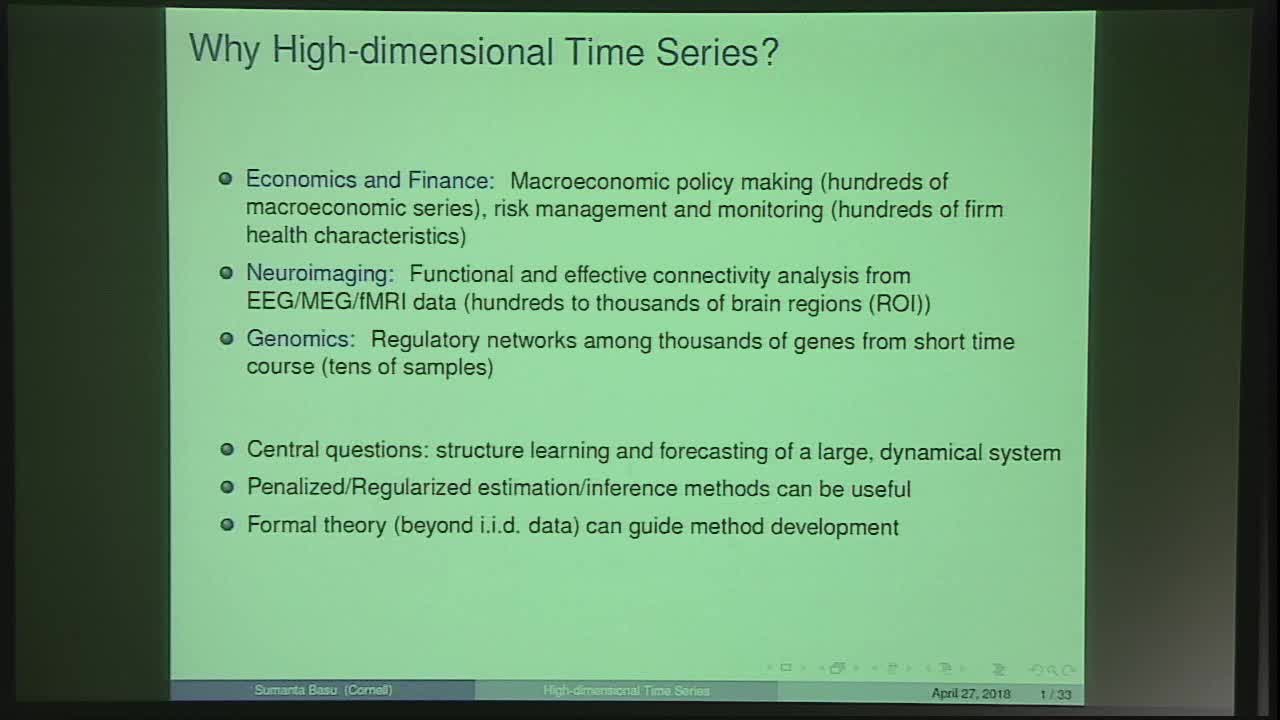

The problem of learning interactions among the components of a large system from time series data is becoming increasingly common in many areas of biological and social sciences. Examples include learning regulatory interactions from time course gene expression data, understanding policy implications from a large number of macroeconomic time series, risk management and monitoring of financial institutions and exploring functional connections among different regions of human brain. Regularization methods encouraging structured sparsity on model parameters have seen empirical success in many of these problems. Studying asymptotic properties of these methods in high-dimensional time series settings, on the other hand, is still a topic of ongoing research. Despite a lot of progress in high-dimensional statistics over the past two decades, high-dimensional time series problems pose interesting challenges due to the presence of temporal and cross-sectional dependence in data. In this talk, I will present some works in this area. I will focus primarily on structure learning and inference of high-dimensional vector autoregression (VAR), a canonical model in multivariate time series, and show some applications in monitoring systemic risk in the US financial sector. If time permits, I will discuss how the key insights can be used in vector autoregressive moving average (VARMA), impulse response and spectral density estimation problems from high-dimensional time series data.